Ontario has always been my home and remains. I’ve been fortunate to also have deep Atlantic Canadian roots and Western Canada experiences. I’ve been exposed to various cultures and environments in Canada for so long it has no doubt shaped my adventurous spirit. In 1995 passing the welcome to Mississauga sign when moving from Toronto with my brothers and mother I recall seeing the population sign say 350,000. As of this year in 2018 Mississauga is peaking towards 1 million. The GTHA has grown significantly the last 20 years with no change of pace expected, this extends to the Waterloo Region as well, a place I equally feel and call home.

I’m not an economist, politician or public policy professional however I’m an aware engaged private citizen. This upcoming Ontario provincial election will have a lasting impact on the policy direction on not only where Ontario is headed in the future but potentially Canada as a whole with the federal election coming up in 2019. All eyes will be on Ontario the next few weeks as the new government forms and people take to the polls. Some will care, many will not, however the results will make an impact direct or indirect on everyone’s wallets.

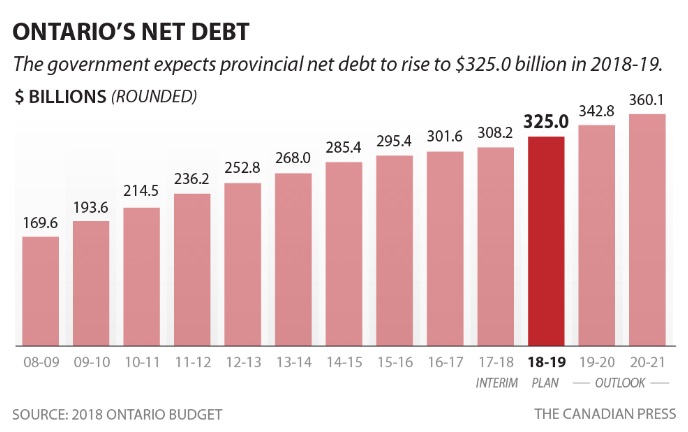

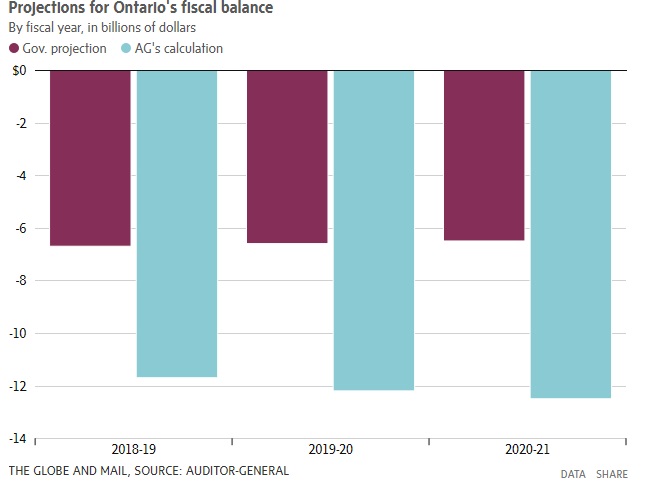

Debt when properly used as a financial instrument of leverage allows our country and economy to expand at great lengths. Financing student, vehicle, consumer purchases, and housing. Debt is a tool of financial freedom and flexibility, however when mismanaged or abused it can have extreme negative consequences and become a prison. I think it is very prudent and responsible that before leveraging our future cost anymore collectively as a province and country we don’t abandon our principals of fiscal responsibility. The same responsibility that is placed on every home and individuals budget should be shared for those who govern. If Ontario’s Auditor General’s calculations are accurate we really do need to reflect and re-consider the direction we’re going and how will get back to balance or if that is something that is even valued anymore.